Hiring Your First Employee? Legal Must-Dos for New Employers

Hiring an employee for the first time is a big step for any small business owner. It shows growth and brings new opportunities, but it also comes with important responsibilities.

Employers must be aware that there are specific legal steps required before and after bringing someone onto their team to ensure compliance and avoid potential future problems.

There are several essential tasks, including registering for an Employer Identification Number, setting up payroll tax accounts, and reporting new hires to the state.

Employers also need to complete proper forms, such as the I-9 for verifying work eligibility and the W-2 to report wages at year’s end.

Following these legal requirements for hiring employees protects both the business and its workers.

Understanding what is required up front helps small business owners feel confident and prepared.

Key Takeaways

- Hiring your first employee triggers multiple legal obligations at the federal and state levels.

- Contracts, onboarding, and classification mistakes can expose your business to costly penalties.

- With flat-fee employment contracts and affordable legal memberships, Surge Business Law helps you stay compliant from day one.

Before You Hire: Legal Steps You Can’t Skip

New Texas employers must complete key steps before hiring their first employee.

These legal requirements help protect the company, ensure hiring practices comply, and set the business up for smooth payroll and tax reporting.

Obtain an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is required to employ staff and pay taxes legally.

The IRS uses the EIN to identify a business for tax purposes. This is sometimes referred to as a Federal Tax Identification Number.

A business owner can apply for an Employer Identification Number (EIN) through the IRS, either online or by mail. The process is simple and usually free.

The EIN will be used on almost every tax document, including employment tax forms and payroll reporting.

The EIN must be obtained before making a first hire because it is required to report wages, pay Social Security taxes, and file the necessary tax forms.

Without it, the employer cannot pay or withhold proper taxes from a new hire’s paycheck.

Register with the Texas Workforce Commission

All Texas employers who pay wages must register with the Texas Workforce Commission (TWC).

This registration is necessary even for businesses with just one employee in the state.

The TWC tracks payroll taxes and unemployment insurance contributions.

When a business registers, it receives a TWC account number, which is used when reporting employee wages and paying state unemployment tax.

Registration can be done online via the TWC website.

After an account is set up, the employer must report each new hire to the state’s new hire reporting program.

This helps ensure unemployment insurance coverage and helps the state track child support obligations.

Set Up State and Federal Tax Withholding Accounts

Employers are required to withhold certain taxes from employees’ pay. These include federal income tax, Social Security, Medicare, and state unemployment tax.

Setting up withholding accounts ensures the correct amounts are collected and reported.

The IRS requires the business to withhold federal income tax using Form W-4, which every new hire must complete.

Social Security and Medicare taxes are deducted based on set percentages.

Texas does not have a state income tax, but it does require state unemployment tax withholding.

Employers should set up proper payroll processing or choose a payroll service to manage these accounts.

Accurate withholding and depositing of taxes prevents costly penalties and audit problems for the business.

Verify Employment Eligibility (Form I-9)

Before the new hire starts work, the employer must confirm that the person is eligible to work in the United States.

This is done with the federal Form I-9.

The hiring manager needs to review documents such as a Social Security card or passport to verify identity and work authorization.

The employer must complete Section 2 of Form I-9 within three days of the employee’s first day.

It is illegal to hire workers who are not authorized for employment in the U.S.

Employers are required by law to retain Form I-9 for every employee.

Surge Business Law makes hiring legally simple—get a flat-fee employment agreement tailored to your business today. Contact us to schedule now.

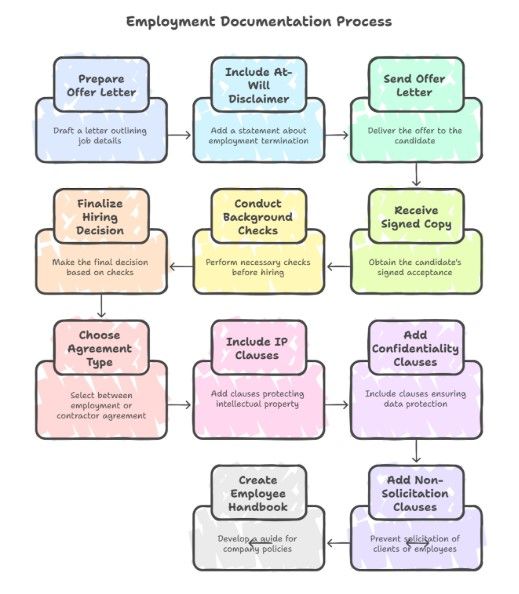

Required Employment Documentation and Agreements

Every new hire needs to start with clear documents.

Putting the right agreements in place protects the employer and sets expectations from the beginning.

Having the correct paperwork also helps avoid legal problems and confusion during the onboarding process.

Offer Letters and At-Will Disclaimers

An offer letter outlines the job title, primary responsibilities, salary, expected start date, and work schedule.

It should specify whether the position is full-time or part-time, outline job requirements, and clearly explain the basic terms of employment.

Including an at-will disclaimer is important for employers in most states.

This statement tells the new hire that either party can end employment at any time and for any legal reason.

When sending the offer letter, it is best to ask the best candidate to sign and return a copy for the company’s records.

Offer letters also often include next steps, such as background checks or reference checks, before a final hiring decision is made.

A clear letter enhances the onboarding process and helps the new employee understand their job description and the details of their job offer.

Employment Agreement vs. Independent Contractor Agreement

Employers should understand the difference between an employment agreement and an independent contractor agreement.

An employment agreement is used for workers who become a regular part of the team.

It covers pay, benefits, job duties, and company policies.

It can also mention how performance is evaluated and the process for solving problems.

An independent contractor agreement is typically used for individuals hired for a specific project or short-term job.

This agreement outlines the tasks to be completed, deadlines, and payment terms, but it does not dictate the person’s work in detail.

Classifying someone correctly is important because independent contractors typically do not receive employee benefits and are responsible for their own taxes.

Misclassifying workers can lead to fines and legal issues.

Review each candidate’s role, interview process outcome, and job requirements closely to determine which agreement is best suited to the situation.

IP, Confidentiality, and Non-Solicitation Clauses

Employment documents should include clauses on intellectual property (IP), confidentiality, and non-solicitation if the job involves handling sensitive data, business secrets, or creative work.

Intellectual property clauses explain that any work or invention created on the job belongs to the company.

Confidentiality clauses clearly state that employees must not disclose private information outside the workplace, thereby protecting company data and customer information.

Non-solicitation clauses stop employees from taking clients or other team members with them if they leave.

These terms are especially important for jobs that involve access to sensitive information, such as contacts, business plans, or proprietary company systems.

Employee Handbook (Even for Small Teams)

An employee handbook is helpful, even for a company with just one or two employees.

It provides written rules regarding time off, procedures for requesting sick leave, safety policies, dress code guidelines, and general company conduct.

A handbook supports a smooth onboarding process and gives new hires a clear reference for questions about expectations, benefits, and workplace culture.

It can also explain how to raise concerns, who to contact, and what steps to take if problems arise.

Handbooks may include information about structured interview processes, training, problem-solving abilities, and team culture.

Workplace Compliance: Federal and Texas Requirements

Employers in Texas are required to comply with specific regulations regarding employee rights, compensation, and workplace safety.

The law requires proper notices, detailed records, and accurate pay to prevent fines and ensure a safe workplace.

Display Required Labor Law Posters

Federal and Texas law require employers to display specific labor law posters in a visible area where all employees can see them.

These posters outline key employee rights, including the minimum wage, workplace safety, anti-discrimination laws, and family leave policies.

Employers must include both federal notices, like those under the Fair Labor Standards Act (FLSA), and Texas state notices.

Some posters cover federal laws, while others focus on Texas rules about new hire reporting and employment.

Failing to post the right notices can result in penalties or complaints.

Employers should check for updated versions of each poster and replace old ones as regulations change.

Some notices, like workers’ compensation and unemployment insurance, are required even if the company has only one employee.

Maintain Proper Records

Maintaining accurate and organized employee records is a legal requirement.

Records must include job applications, Form I-9s for verifying work eligibility, tax forms such as the W-4, and proof of onboarding compliance.

Employers should keep records of employee pay, hours worked, and withholdings for at least three years.

Texas law and the IRS both require certain retention periods.

Employment records also help resolve future disputes, verify employee benefits, and demonstrate compliance during tax or labor audits.

Employers with workers’ compensation insurance must maintain relevant claim records and notices.

Secure storage and confidentiality are critical. Both digital and paper files must be protected to ensure privacy and meet legal data requirements.

Payroll and Wage Compliance

Correct payroll processing is crucial for complying with both federal and Texas wage laws.

Employers must withhold the right employment taxes from paychecks, submit those taxes, and issue required forms at year-end (such as the W-2).

Texas does not have a state income tax, but federal payroll taxes still apply.

Employers must pay at least the federal minimum wage and comply with overtime laws as outlined in the Fair Labor Standards Act (FLSA).

Dedications for things like benefits must be documented.

Prompt and accurate pay supports onboarding and keeps employees satisfied.

Setting up a solid payroll system or working with a professional, such as a certified public accountant (CPA), helps avoid errors and penalties.

Keeping up with deadlines for pay, tax deposits, and filings is necessary for full payroll and wage compliance.

Avoid common mistakes when hiring your first employee. Join Surge Business Law’s Momentum Membership for just $95/month. Contact us today.

Hiring in Texas? Know These Local Employer Laws and Best Practices

Texas has a reputation for having business-friendly employment laws, but employers should still be aware of local requirements.

Understanding key rules, implementing smart hiring practices, and maintaining accurate documentation can help avoid future legal problems.

Texas Is “Employer-Friendly,” But That Doesn’t Mean Lawless

Texas laws often provide employers with more flexibility than those in some other states.

For example, the state follows an “at-will” employment policy, allowing businesses to terminate employment at any time unless a contract states otherwise.

However, federal rules, such as the Fair Labor Standards Act and anti-discrimination laws, still apply.

Employers must also collect required paperwork, including IRS Form W-4 and new hire forms, by the first day of work.

Best practices include clear job descriptions and fair recruitment. Keeping good records is also important.

Why Austin Employers Should Still Have Custom Agreements

Even in an at-will state, custom employment agreements help set clear terms for both sides.

Contracts can outline pay, duties, schedule, and expectations.

Non-disclosure or non-compete clauses may also be appropriate, particularly for positions involving sensitive information. Non-compete clauses can introduce complications, so if you think your business needs an enforceable non-compete, please contact us to get advice.

In cities like Austin, workplaces may be more diverse.

Clear, written agreements ensure that all employees understand the rules and benefits, supporting a culture of inclusion.

Including diversity and anti-discrimination policies in handbooks demonstrates a commitment to fair treatment.

Avoiding Common First-Time Employer Mistakes

Employers must comply with strict rules under both state and federal employment laws.

Mistakes not only lead to fines but can also result in lawsuits or damage to a business’s reputation.

Misclassifying a Contractor as an Employee

A frequent error is labeling a worker as an independent contractor when, in fact, they are an employee.

This can happen if the business controls how, when, and where the work is done.

Filing taxes incorrectly and failing to follow wage laws are common risks associated with misclassification.

The IRS and the Department of Labor have specific tests that help determine whether a worker is an employee or a contractor.

Misclassifying workers can result in needing to pay back taxes and penalties.

Employers could also face problems if an employee claims benefits or overtime that were denied.

A quick checklist to avoid this mistake:

- Review control over the worker’s tasks and schedule

- Offer only employee benefits to true employees

- Consult IRS guidelines or a labor attorney for tricky cases

Not Paying Overtime When Legally Required

Wage and hour laws set strict rules about overtime pay. If an employee works more than 40 hours a week, they are often entitled to time-and-a-half pay.

Some new employers misclassify workers as “exempt” to avoid paying overtime, which can be a violation of the law. If you think your workers are exempt from overtime, contact us to ensure your goals are met.

Employers must also keep detailed records of hours worked.

Failing to pay overtime as required can result in lawsuits, fines, and the requirement to repay wages.

It’s important not to assume a role is exempt without checking the rules.

Using reliable time-tracking tools is beneficial, as is regularly reviewing payroll practices.

Skipping Legal Review of Onboarding Documents

Every new hire must complete forms like the W-4 and I-9.

Missing or outdated onboarding paperwork can result in fines from agencies such as the IRS or the Department of Homeland Security.

Employers are also expected to provide clear notices about workplace rights, pay, and protected categories such as race, religion, or gender.

Failing to conduct a legal review of these documents may compromise compliance with anti-discrimination laws and other employment regulations.

A qualified attorney or HR expert should review offer letters, contracts, and other employment-related documents to ensure they are accurate and compliant with relevant laws and regulations.

Common onboarding documents to review:

- Offer letter and employment agreement

- Tax forms (W-4, I-9)

- Anti-discrimination and harassment policies

How Surge Business Law Helps First-Time Employers Launch Smart

Surge Business Law guides first-time employers with legal too00ls designed for new business owners.

Their services help employers avoid mistakes and stay compliant from the start.

Flat-Fee Employment Agreement Packages

Surge Business Law offers flat-fee packages for employment agreements.

This means employers know the cost upfront and do not have to worry about surprise legal fees.

Each package includes a ready-to-use contract, making it faster to hire new team members.

The agreements comply with both federal and state laws and are tailored to meet the employer’s specific business needs.

Surge’s legal team ensures that all employee rights, duties, and company policies are clearly outlined and communicated to employees.

Employers also receive guidance on common hiring challenges, including determining the appropriate pay terms, incorporating confidentiality clauses, and navigating termination procedures.

This guidance helps avoid lawsuits and miscommunication.

For many small business owners, knowing that these details are handled boosts their confidence when making hiring decisions.

Ongoing Legal Support via Momentum Membership

The Momentum Membership provides employers with ongoing legal support as their business expands.

Members get access to on-call legal advice for everyday questions about employee issues, contracts, and business policies.

This membership includes regular updates on new employment laws and compliance rules.

Employers can ask questions, request policy reviews, and seek assistance with sensitive situations, such as workplace complaints or disciplinary actions.

Surge Business Law also provides templates, checklists, and reminders for important legal deadlines.

Having a trusted legal partner like Surge means employers do not have to handle problems alone or guess what to do next.

Hiring help in Austin? Let Surge Business Law handle contracts, classification, and compliance—reach out to book your free consult.

Frequently Asked Questions

What legal steps are required to hire an employee in Texas?

You need an EIN, must register with the Texas Workforce Commission, set up tax withholding, complete Form I-9, and follow federal labor laws.

Do I need a written employment contract for my first hire?

While not legally required in Texas, a written employment agreement outlines roles, compensation, and protections, which can be especially helpful for startups and small businesses.

What is the difference between a contractor and an employee?

Contractors are independent and control their work. Your business is responsible for managing employees and must comply with laws regarding wages and benefits.

What posters must I display as a new employer?

You must display both federal and Texas labor law posters in a location that is easily visible to employees. These include wage, safety, and discrimination notices.

Can I pay a salaried employee without overtime?

Only if they meet the federal exemption criteria under the FLSA, otherwise, overtime rules apply even to salaried roles.

What happens if I misclassify an employee as a contractor?

You may owe back taxes, penalties, and interest, and could face lawsuits. It’s a common but costly mistake for new employers.