4 Types of Intellectual Property: Securing Your Business Benefits

Did you know that finding success in today’s fiercely competitive business landscape requires protection of your ideas, inventions, and…

Did you know that finding success in today’s fiercely competitive business landscape requires protection of your ideas, inventions, and…

Tax planning can be overwhelming. If you’re wondering what taxes a small business has to pay, which deductions my…

Establishing a strong brand identity is one of the most important actions you can do to ensure success in…

Once upon a time in a quaint little town, there lived a passionate baker named Emma. Emma had spent…

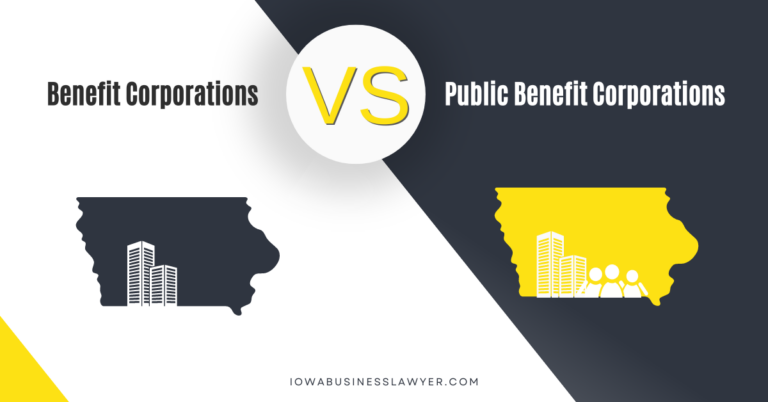

An Iowa benefit corporation is a for-profit corporation with a purpose to help the public, while a public benefit corporation is a charitable non-profit corporation.

Another company is using my name! We worked with a business owner who had a competitor start a business…

Why do we on the Iowa Business Lawyer team care so much about small businesses? Well, small business ownership…

Free help for Iowa LLC owners—every other year you have to file a biennial report. If you’d like help,…

Define IP, IP types, and their differences, understand the benefits of IP protection, and discover how to get IP…

Buying or selling a business can be a great opportunity for both the buyer and seller. Learn about the key risks and make a plan.

Subscribe today to get our business newsletter! Your personal info is never shared. 🤐