Buying or Selling a Business in Iowa – What You Need to Know

We love helping our clients buy or sell a business and have worked with many clients on deals as small as $30,000 up to millions. Buying or selling a business in Iowa isn’t as straightforward as it might seem. Every Iowa business sale or purchase involves several key steps, including legal, financial, and tax considerations.

Sadly, too often clients come to us because a deal turned out to be bad. It’s hard to fix something that’s already done, so it’s better to get it right from the start. From drafting letters of intent to finalizing contracts, an experienced Iowa business attorney helps protect your interests at every stage.

Iowa enforces its own state regulations and filing requirements, in addition to those required by the federal government.

Navigating Iowa’s unique legal landscape means you have to juggle state statutes and local licensing requirements, too.

The legal process comes in stages. You’ll deal with initial agreements, due diligence, and the final transfer—each part has its own paperwork and rules.

Key Takeaways

- Business transactions in Iowa must comply with both state and federal legal requirements.

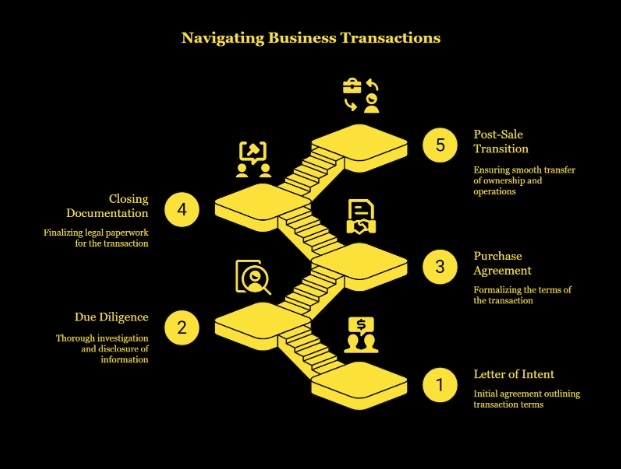

- The process is broken down into five main stages, each with its own set of documents.

- Working with an Iowa business attorney can save you from headaches and expensive mistakes.

The 5 Legal Stages Of A Business Transaction

Every business sale in Iowa moves through a set of legal stages. These steps help protect both sides and keep the deal on track.

You’ll need to handle paperwork, review records, and negotiate terms before you can call the business yours.

Stage 1- Letter Of Intent (LOI)

The letter of intent, or LOI, kicks off the formal process. It lays out the basic terms of the sale without locking anyone in just yet.

Most LOIs cover the purchase price, payment details, and a timeline for closing the deal. They also list the assets that are included and outline any conditions that must be met.

With the LOI in place, both sides can move forward with some peace of mind. Sellers usually take the business off the market for a while, showing they’re serious.

Key LOI Components:

- Purchase price and payment terms

- Asset inclusion and exclusion list

- Due diligence timeline

- Confidentiality requirements

- Exclusivity period

- Details on when employees and customers find out

Most LOIs set a 30 to 90-day exclusivity window. Sellers agree not to entertain other offers during this time.

The LOI also establishes deadlines for due diligence and the execution of the purchase agreement. These deadlines help keep things moving.

Note that a business may suffer serious harm if employees or customers find out about a potential sale at the wrong time. This is an important component of the LOI and should be planned carefully with the help of an attorney.

What is the difference between a letter of intent and an offer letter?

We commonly see brokers use offer letters rather than LOIs. An offer letter intends to be a binding contract, while an LOI is typically non-binding.

A binding offer can be great for a buyer if there are many interested buyers. By locking in a deal, the seller cannot accept an offer from another party until the terms of the offer have been met or are expired.

A binding offer can be great for a seller when there are few buyers and the seller wants a firm commitment. It’s also good when the seller or buyer must take on obligations that take time and money. If the buyer wants out of a deal like this, there is usually a cost.

An LOI is better when parties are serious but not ready to set the terms of the deal in stone. While offer letters typically have a way out, it’s more complicated than an LOI.

Stage 2- Due Diligence And Disclosures

Due diligence is when buyers thoroughly examine the business’s details. They’ll want to review financial records, legal paperwork, and observe how things operate on a day-to-day basis.

Buyers typically request three to five years of financial records, including tax returns, contracts, and employee agreements.

Sellers must be upfront about any outstanding debts, pending lawsuits, and any regulatory issues. If buyers uncover problems later, things can get messy fast.

Common Due Diligence Items:

- Financial statements and tax returns

- Customer contracts and supplier agreements

- Employee records and benefit plans

- Insurance policies and claims history

- Intellectual property documentation

Accountants and attorneys usually step in to help with due diligence. Accountants verify the numbers, while lawyers review contracts and assess legal risks.

This stage can drag on for weeks if the business is complicated. Buyers might ask for more info or clarification along the way.

Stage 3- Negotiating The Purchase Agreement

The purchase agreement is where all the final terms land. This contract supersedes the LOI and provides detailed terms and conditions.

Negotiations get real here—price changes, liability issues, and seller promises all come up. Buyers may request price reductions if they identify issues during due diligence.

Key Negotiation Points:

- Final purchase price and payment structure

- Seller representations and warranties

- Buyer and seller liability limits

- Non-compete agreement terms

- Employee retention requirements

The agreement outlines who is responsible for handling old debts and legal issues. It also covers what happens if trouble pops up after closing.

Sellers usually promise that the business is in good shape and the numbers are right. These promises protect buyers if they find hidden issues later.

Negotiations often go back and forth a few times. Both sides really need a lawyer watching their backs here.

Stage 4- Closing Documentation

Closing is where the business officially changes hands. Both sides sign a stack of documents, and everything is filed correctly.

Licenses, permits, and registrations transfer to the new owner. Banks and suppliers get notified about the change.

Required Closing Documents:

- Bill of sale for business assets

- Assignment of contracts and leases

- Transfer of licenses and permits

- Loan assumption or payoff documents

- Employment agreement transfers

Payment happens at closing—usually by wire or certified funds. The buyer gets the keys, passwords, and access to systems and accounts.

If real estate is part of the deal, title insurance might be needed. That way, the buyer is protected against ownership disputes or hidden liens.

Everyone signs the final documents with an attorney or notary present. Closings traditionally happen at a law office or bank. That said, an increasing number of our closings are virtual. If the parties agree, closing can happen while you enjoy a drink on the beach!

Stage 5- Post-Sale Transition

The transition period helps the new owner become familiar with the business. Sellers typically stay for a while to assist with training and introductions.

Many deals include a 14 to 90-day transition window. Sellers introduce buyers to customers and walk them through daily operations.

Transition Activities:

- Customer and vendor introductions

- Employee training and retention

- System access and password transfers

- Ongoing project completion

- Financial account transfers

Non-compete agreements prevent sellers from immediately competing with their former employers. Buyers need this protection for their investment and to maintain healthy relationships.

Sometimes, sellers stay on as consultants or even employees for a while. It’s not always easy to let go, and buyers appreciate the support.

Regular check-ins between the two sides help smooth out bumps. Careful attention to post-closing details ensures that things don’t fall apart after the ink dries.

Buying or selling a company in Iowa? Surge Business Law makes the process smoother with clear guidance on contracts, filings, and compliance. Contact us today to begin.

Key Legal Documents In Iowa Business Sales

Every business sale in Iowa needs certain legal documents. These protect both parties, maintain confidentiality, and ensure the transfer is official.

NDA And LOI

Non-disclosure agreements, or NDAs, keep sensitive information safe during the sale process. Sellers must share a lot—financials, customer lists, and trade secrets—with buyers.

Key NDA Components:

- Financial information protection

- Customer data confidentiality

- Trade secret safeguards

- Employee information limits

NDAs prevent buyers from disclosing information to competitors or using it for their own benefit; most last two to five years after signing. Note, even with an NDA, sellers should not disclose all of their protected client, vendor, or trade secret information to buyers before closing without clear legal protections.

The Letter of Intent (LOI) comes next. This document outlines the basic deal terms prior to the final agreement being finalized.

LOI Elements Include:

- Purchase price range

- Payment structure

- Due diligence timeline

- Closing date estimate

LOIs aren’t legally binding, but they demonstrate the buyer’s seriousness. Both sides can move ahead with a little more confidence.

Purchase Or Asset Agreement

The purchase agreement is the primary contract for business sales in Iowa. Asset deals involve the buyer acquiring specific items, such as equipment or inventory.

Asset Purchase Agreements Cover:

- Which assets transfer to the buyer

- Assumed liabilities and debts

- Employee transfer terms

- Warranty and representation clauses

Stock purchases are different because the buyer receives shares, thereby assuming all assets and liabilities of the business entity.

Stock Purchase Terms Include:

- Number of shares sold

- Price per share calculation

- Existing debt responsibilities

- Management transition plans

Business sale documents formalize the deal and help prevent future disputes.

Bill Of Sale / Stock Certificate

The bill of sale moves business assets from the seller to the buyer. It lists each asset and its condition.

Required Bill of Sale Information:

- Detailed asset descriptions

- Serial numbers for equipment

- Current asset conditions

- Transfer date and signatures

Stock certificates prove ownership of company shares. In stock deals, sellers hand over signed certificates to buyers.

The certificates should include:

- Company name and state

- Number of shares transferred

- Certificate numbers

- Proper signatures and dates

Both documents serve as proof of ownership. If questions come up later, these papers keep things clear.

Non-Compete And Transition Agreement

Non-compete agreements prevent sellers from starting a rival business immediately after the sale. Iowa courts usually enforce reasonable non-compete terms.

Typical Non-Compete Limits:

- 1-3 year time restrictions

- Specific geographic boundaries

- Limited business scope

- Fair compensation terms

Transition agreements help sellers train buyers and hand off relationships. These contracts outline the seller’s responsibilities during the transition.

Common Transition Services:

- Customer relationship transfers

- Employee training periods

- Vendor relationship introductions

- Operational procedure reviews

Transition periods usually last 30-90 days. Sellers often receive compensation for their assistance during this period.

From due diligence to closing documents, Surge Business Law helps Iowa business owners avoid costly mistakes and protect their deals. Schedule your consultation now.

Common Legal Mistakes Iowa Business Owners Make

Many Iowa business owners make mistakes during transactions, resulting in costly issues. The usual culprits?

Overlooked debts or liens, missed intellectual property transfers, ignored employee issues, and payment terms that just don’t work.

Failing To Verify Liens Or Debts

Many Iowa business owners overlook due diligence when buying or selling a company. That shortcut can saddle them with unexpected financial obligations that come with the business.

Liens are a big blind spot for many. These documents show secured debts tied to business assets. If buyers skip checking these records, they may end up with loans they never intended to sign up for.

Tax liens cause headaches, too. The Iowa Department of Revenue can slap liens on business property for unpaid state taxes. The IRS can do the same at the federal level, attaching liens to business assets.

Outstanding vendor debts often catch new owners off guard more frequently than you might think.

Sometimes, previous owners leave unpaid bills with suppliers or contractors behind. Depending on the deal’s structure, those debts can land in the buyer’s lap.

Smart buyers should always ask for a comprehensive debt list from sellers. This list should cover:

- Bank loans and credit lines

- Equipment financing agreements

- Accounts payable balances

- Tax obligations

- Legal judgments

Professional accountants can double-check these numbers through financial audits. Skipping this step is risky—hidden liabilities can wreck your investment.

Not Transferring Intellectual Property

Intellectual property transfer slip-ups spark real legal trouble for Iowa business buyers and sellers. Deals fall apart all the time when people fumble these assets.

Trademarks and trade names need specific paperwork. Buying a business doesn’t mean you automatically get to use its brand names or logos. Sellers must file the correct assignments with the USPTO.

Customer lists and databases can be goldmines for most businesses. These assets need clear transfer language in the purchase agreement; if the paperwork is fuzzy, sellers might still have legal access to customer info.

Employment contracts sometimes include intellectual property clauses that can complicate matters.

Key employees may have signed agreements granting them rights to specific processes or client relationships. Buyers should dig into these contracts before signing anything.

Software licenses are another headache. Many business software agreements don’t allow for the transfer of ownership to new owners.

Buyers need to know which licenses they can retain and which ones require new contracts.

Trade secrets and proprietary processes need careful handling during transfers. Both sides should sign confidentiality agreements before sharing sensitive details. The purchase agreement must clearly specify which trade secrets are transferred to the new owner.

Honestly, you need a lawyer for tricky intellectual property transfers. It’s just too easy to lose big money—or rights—over a paperwork error.

Skipping Employment Law Obligations

Employment law can become a complex maze during business transfers in Iowa. If new owners fail to comply with these rules, they may face lawsuits or government fines.

Worker classification issues pop up a lot during ownership changes. Iowa Workforce Development checks whether workers are truly employees or independent contractors. Misclassifying workers can cost you back taxes and penalties.

Most existing employment contracts stick with the new owner. Buyers must review all employee agreements to understand wage promises, benefits, and the process for handling terminations.

WARN Act requirements matter for bigger businesses planning layoffs. Companies with 100 or more employees must provide 60 days’ notice before implementing significant layoffs or plant closures. Mess this up and you’re looking at major penalties.

Don’t forget MINI WARN Act requirements! Iowa and each state have additional requirements that apply to many smaller businesses.

Transferring benefit plans adds more complications. Health insurance, retirement plans, and paid time off all need careful handling. COBRA obligations may require you to maintain health coverage for former employees.

New owners really should run employment audits before closing a deal. The audit should check:

- Wage and hour compliance

- Safety training records

- Anti-discrimination policies

- Workers’ compensation coverage

Having an employment law expert on your side can save you from lawsuits down the road.

Poorly Structured Payment Terms

Messy payment terms can drain money and pile on risk for Iowa business owners. Both buyers and sellers need payment plans that actually protect them.

Seller financing needs tight documentation. Sometimes sellers agree to get paid over time instead of all at once. If the deal isn’t legally solid, sellers may struggle to collect or regain their business if buyers stop paying.

Earnout provisions get tricky fast. These tie part of the price to future business performance. If nobody defines how to measure earnings, disputes arise between buyers and sellers.

Security interests help sellers who finance deals. Sellers should file UCC-1 statements to secure their stake in business assets. That way, if buyers bail on payments, sellers can legally reclaim assets.

Escrow accounts provide both parties with some reassurance. These hold part of the purchase price until specific conditions are met. Typical escrow triggers?

- Tax clearance certificates

- Lease assignment approvals

- Customer contract transfers

- Equipment inspections

Personal guarantees from buyers provide an additional safety net for sellers. These guarantees make buyers personally responsible for business debts if their company is unable to pay.

Seeking legal and accounting advice is smart when payment structures become complicated. Common legal mistakes made by small businesses often start with payment terms that seem simple but aren’t.

Iowa-Specific Regulations

Iowa has its own set of legal requirements for buyers and sellers in business transactions.

There are specific filing steps, state notifications, and tax reporting rules that differ from those in other states.

UCC Filings And Releases

The Uniform Commercial Code governs secured transactions in Iowa business sales. Sellers must identify all UCC liens against business assets prior to closing.

Active UCC filings create legal claims on stuff like equipment, inventory, or accounts receivable. These liens remain attached to the assets unless they are properly released.

Buyers should always search UCC records through the Iowa Secretary of State. This search reveals existing security interests that may affect your ownership rights.

Required steps include:

- Doing thorough UCC searches with the help of an attorney or a bank

- Getting lien releases from secured parties

- Filing UCC termination statements when needed

- Making sure there’s a clean title transfer for all assets

If you ignore UCC filings, you could end up responsible for the seller’s debts. Always have a lawyer review these before assets change hands.

Secretary Of State Notifications

Business transactions in Iowa require specific filings at the Secretary of State’s office. The paperwork you need depends on your business structure and the type of deal you’re conducting.

LLC ownership transfers require amendments to the operating agreement filed with the state. Corporate stock sales need updated shareholder records and board resolutions.

Asset sales usually need less state filing than ownership transfers. Still, transferring the business name means you need the right documentation.

Common filing requirements:

- Articles of amendment for ownership changes

- New registered agent appointments

- Updated business addresses

- Dissolution paperwork for closing entities

The Iowa Secretary of State handles these documents, but they won’t give legal advice. You really need a lawyer to figure out the right steps.

Tax Reporting For Business Sales

Iowa business sales trigger specific tax obligations for both sides. Sellers have to report capital gains or losses on their taxes for the year of the sale.

Sales tax clearance might be needed before closing. Businesses with sales tax permits must file current returns and pay up any overdue amounts.

Income tax returns must reflect the business sale in the year it occurs. Asset sales and stock sales get different tax treatment under Iowa law.

Key tax considerations:

- Bulk sale tax clearance certificates

- Final employment tax returns

- Property tax prorations

- Estimated tax payments on gains

Buyers can inherit tax liabilities if they fail to obtain the necessary clearances. Hire a tax professional to ensure you’re complying with Iowa rules and federal law.

Why Hire An Iowa Business Attorney

Iowa business deals are a complex legal maze, with state rules and federal requirements that can quickly become complicated.

A good attorney protects buyers and sellers from costly mistakes and ensures that every legal requirement is handled from start to finish.

Review And Negotiation Support

Business attorneys look over purchase agreements to catch bad terms before you sign. They review asset purchase agreements, stock deals, and merger paperwork to protect your interests.

Lawyers negotiate for better prices, payment schedules, and contingencies. They’ll handle discussions about earnest money, closing costs, and determining who pays for what.

Attorneys help you navigate tricky legal issues that pop up in business deals. They spot risks that most people miss, such as overreaching non-compete clauses or warranties that simply don’t make sense.

Legal pros also review employment contracts for key staff. They’ll ensure that employee benefits are transferred smoothly and handle any labor or union contract issues.

Compliance And Due Diligence

Iowa business attorneys check that companies have the right state licenses before closing. They review corporate filings, tax compliance, and regulatory permits for business operations.

Due diligence involves thoroughly reviewing financial records, contracts, and legal obligations. Lawyers uncover hidden liabilities that could cause trouble later, such as unpaid taxes, lawsuits, or environmental issues.

Iowa business law specialists are familiar with the state’s rules governing business transfers. They ensure that creditors are notified, bulk sale laws are followed, and Iowa corporate statutes aren’t ignored.

Attorneys also verify intellectual property ownership and transfer rights. They’ll confirm that trademarks, patents, and copyrights transfer to the new owner without any legal issues.

Representation During Closing

Business lawyers jump in to coordinate the closing process. They ensure that all documents are signed correctly.

They review final settlement statements. Lawyers check that every condition in the purchase agreement is actually met.

Having a lawyer present at closing can help prevent last-minute problems that could compromise the deal. Attorneys handle wire transfers, set up escrow accounts, and record documents with the county offices.

Professional legal help streamlines transactions and helps everyone avoid those annoying delays. They collaborate with accountants, real estate agents, and lenders to ensure things move on schedule.

After closing, attorneys handle tasks such as transferring business licenses. They also handle updates to corporate records.

They notify the Iowa Secretary of State and other agencies about the new ownership. Someone has to, right?

Surge Law Trusted by Iowa Business Owners

From startups to established companies, business owners across Iowa trust Surge Business Law for clear guidance, reliable service, and real results.

Mo Yang

“I recently visited this law firm for a consultation regarding setting up an LLC for my rental property. Matt took the time to listen to my situation and generously shared his knowledge with me. He clearly explained why setting up an LLC at this stage was best for my needs.”

Scott Luu

“Surge Business Law was very knowledgeable about the business buying process from start to finish. If I lived in Iowa, I would definitely use their services in the future.”

Van Nguyen

“I had never had any experience as a business owner before. There were many worries and concerns when making the decision to buy a business. I came to Surge Business Law Firm because of great reviews and was not disappointed. They guided me step by step, making the process smooth and less overwhelming.”

Jay Miller

“Great business programs, give advice on TikTok. Has helped my business out tremendously. Love their 5-month program, and rates are reasonable.”

Your business deserves a clean, profitable transition. Surge Business Law offers comprehensive legal support for every stage of business sales in Iowa. Contact us today to get started.

Frequently Asked Questions

Do I need a lawyer to buy or sell a business in Iowa?

Yes. While not legally required, an Iowa business attorney helps with contracts, negotiations, tax compliance, and closing—protecting you from costly mistakes.

What are the main legal stages of selling a business in Iowa?

The process follows five stages: LOI, due diligence, purchase agreement, closing documentation, and post-sale transition. Each stage requires careful legal oversight.

How long does due diligence take in Iowa business sales?

Due diligence typically takes 30–90 days, depending on the business’s complexity. Buyers review financials, contracts, and liabilities, while sellers provide disclosures and records.

What legal documents are required for an Iowa business sale?

Key documents include: NDA, Letter of Intent, Purchase Agreement, Bill of Sale or Stock Certificate, and Non-Compete/Transition Agreement.

What mistakes do Iowa business owners make during sales?

Common errors include failing to verify liens, missing IP transfers, ignoring employment law obligations, and agreeing to poorly structured payment terms.

What Iowa-specific regulations affect business sales?

Sellers must address UCC filings, Secretary of State notifications, and state tax reporting to ensure a clean transfer and compliance with Iowa law.

How are Iowa business sales taxed?

Iowa taxes gains from business sales as ordinary income, not at a separate capital gains rate. Federal capital gains rules still apply.

How can I prepare my Iowa business for sale?

Organize financial records, resolve outstanding debts or liens, update contracts, and conduct a legal pre-audit with an attorney to prevent surprises during buyer negotiations.

How Much Does It Cost to Sell a Business in Iowa – Legal and Transactional Guide

The quoted costs are much higher than typical for a smaller business. My firm focuses on transactions of $5M and under, though up to $10M is fine. Brokers are optional and often there is no broker, meaning no commission. Accounting costs are often also typically minimal. That can mean costs for closing are in the 2-5% range typically.

How Much Can I Sell My Business For in Iowa – Legal Guide to Determining Value

I do not like multipliers based on EBITDA and do not encourage their use at all. For deals in the size I handle, there is almost always an owner/operator who is working in the business. Much of the business profit is going to the owner as salary. For this reason, we use SDE to calculate the valuation.

The EBITDA multiplier is commonly cited and gets people excited because it’s often used for tech startups and absentee-owner businesses that are high profit. A google search will see multipliers of 3-15x EBITDA. But EBITDA is a very misunderstood number and in fact is not even accepted as part of the GAAP measures (Generally accepted accounting principle).

The only mention of EBITDA in the article needs to be to warn clients away from using it and any calculations that use it. It is 100% irrelevant and should be discouraged. This article uses EBITDA 9 times and SDE once. It needs to be the other way around.