Secure an EIN in 5 Simple Steps: A Streamlined Guide for Business Registration

Starting a business involves important paperwork. Getting an Employer Identification Number (EIN) is a key step.

This nine-digit number works like a Social Security number for your business and is needed for taxes, bank accounts, and hiring employees.

You can get an EIN directly from the IRS in just minutes for free by following five simple steps.

The EIN application process is straightforward when you know what to do. Whether you’re a sole proprietor, forming an LLC, or starting a corporation, understanding how to apply properly saves time and prevents headaches.

You can apply online, by fax, mail, or phone, depending on your preference and situation.

Key Takeaways

- An EIN is essential for filing taxes, opening business bank accounts, and hiring employees. It can be obtained for free through multiple IRS application methods.

- Business owners must gather specific information before applying, including legal name, structure details, and responsible party information.

- Once approved, your EIN can be used immediately for important business functions like tax filing and establishing financial accounts.

- It is important to provide accurate and complete information to the IRS to avoid legal problems.

What Is An EIN, And Why Does Your Business Need One?

An Employer Identification Number (EIN) is your business’s tax ID number, similar to a Social Security Number for individuals.

This unique nine-digit number is essential for various business operations and tax obligations.

Definition And Purpose Of An EIN

An EIN, or Employer Identification Number, is a nine-digit number the Internal Revenue Service (IRS) assigns to identify businesses for tax purposes.

Think of it as your business’s Social Security Number. The IRS uses this number to track your business tax filings.

EINs serve multiple purposes beyond just taxes:

- Opening business bank accounts

- Applying for business loans

- Establishing business credit

- Filing tax returns

- Building credibility with vendors and clients

An EIN is essential for nonprofits to develop the organization and maintain tax-exempt status properly.

This identifier remains with the business throughout its lifetime, except with certain structure changes.

Businesses Required To Have An EIN

Several types of business entities must obtain an EIN by law:

- Businesses with employees: Any business that hires employees needs an EIN to manage payroll taxes and withholdings.

- Partnerships and corporations: All partnerships, LLCs with multiple members, S corporations, and C corporations require an EIN.

- LLCs: While single-member LLCs without employees technically can use the owner’s SSN, most still benefit from having an EIN for banking and liability protection.

- Tax-exempt organizations: Nonprofits and charities need an EIN regardless of whether they have employees.

Non-resident business owners in the US also need an EIN because they lack a Social Security Number for tax reporting purposes.

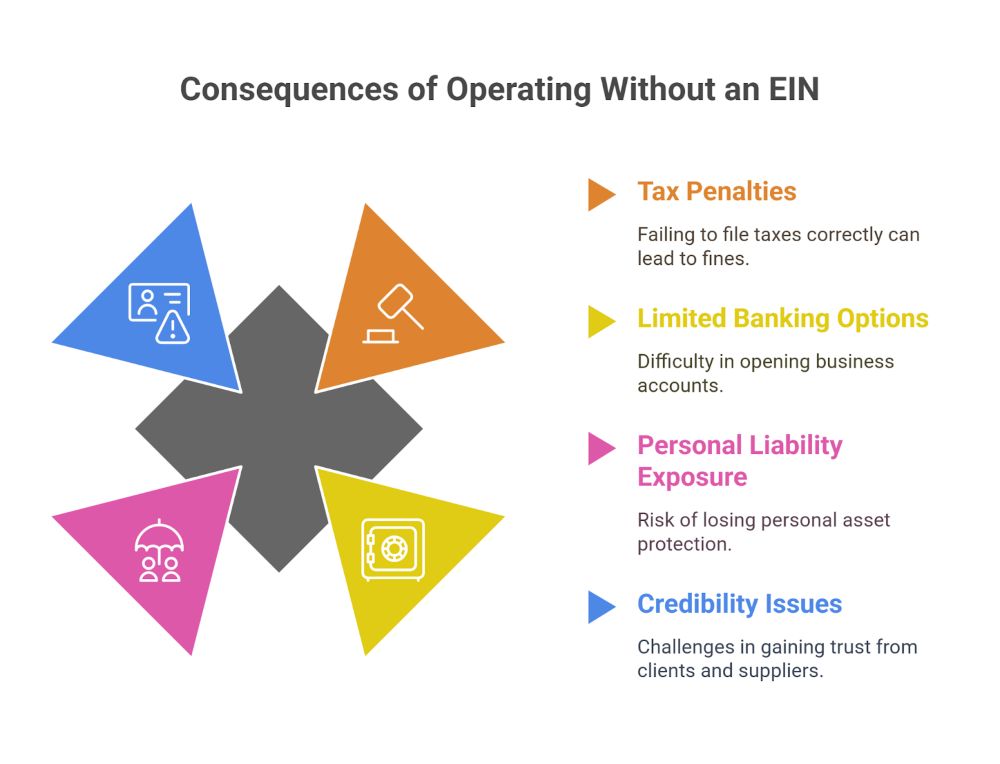

Consequences Of Operating Without An EIN

Operating without a required EIN can lead to serious complications for your business. These issues can impact both legal compliance and practical operations.

Potential consequences include:

- Tax penalties: Failure to file required tax documents with an EIN may result in IRS penalties.

- Limited banking options: Most banks require an EIN to open a business account, making financial management difficult.

- Personal liability exposure: Without proper business documentation, including an EIN, you may lose liability protection that separates personal and business assets.

- Credibility issues: Suppliers and clients may question a business’s legitimacy without proper tax identification.

Additionally, without an EIN, businesses cannot legally hire employees or contractors, limiting growth potential. Correcting missing EIN issues often takes longer than initially applying for one.

Step 1 – Determine Your Eligibility For An EIN

Before applying for an Employer Identification Number, you must verify your qualifications. The IRS has specific requirements for who can receive an EIN, and understanding the differences between identification numbers helps ensure you apply for the right one.

Who Qualifies For An EIN

Businesses operating in the United States or U.S. territories can apply for an EIN if they meet certain criteria.

The principal business must be located in the U.S. or U.S. territories, and the applicant must have a valid Taxpayer Identification Number (TIN).

Eligible entities include:

- Corporations and partnerships

- LLCs (single-member and multi-member)

- Sole proprietorships with employees

- Estates of deceased individuals

- Trusts and non-profit organizations

Even businesses without employees may need an EIN for banking purposes or to establish business credit.

Members must provide specific information about the legal structure when applying for LLCs.

EIN Vs. ITIN Vs. SSN: Key Differences

Understanding the differences between identification numbers is crucial for proper tax filing and business operations.

EIN (Employer Identification Number): The IRS assigns nine-digit numbers to business entities. These numbers are primarily used for tax filing, opening bank accounts, and hiring employees.

SSN (Social Security Number): Issued to U.S. citizens and authorized residents. Sole proprietors without employees can use their SSN for business taxes instead of an EIN.

ITIN (Individual Taxpayer Identification Number): Provided to individuals who need a U.S. taxpayer identification number but aren’t eligible for an SSN. Foreign business owners may need an ITIN before applying for an EIN.

These numbers serve different purposes and cannot be used interchangeably on tax documents or business applications.

Start your EIN journey with ease—partner with Surge Business Law to get your business paperwork done fast and stress-free.

Step 2 – Choose Your EIN Application Method

The IRS offers several ways to apply for your Employer Identification Number, each with different processing times and requirements. Selecting the correct application method depends on your business needs and timeline.

Online EIN Application Via IRS.gov

The online application is the fastest and most convenient option for most business owners. To apply for an EIN online, visit the official IRS website during operating hours (Monday through Friday, 7 a.m. to 10 p.m. Eastern Time).

This method provides immediate processing, allowing you to receive your EIN once your application is completed and validated.

The online system guides applicants through questions about the business entity and ownership structure.

Advantages of online application:

- Instant EIN issuance upon completion

- No paperwork to mail or fax

- Guided process with clear instructions

- Available 24/7 (except for maintenance periods)

To complete the online application, business owners must identify their legal and tax structure and have all relevant business information ready.

Fax, Mail, Or Phone Application

The IRS accepts EIN applications via fax, mail, and phone for those who cannot use the online method or prefer traditional approaches.

These methods are particularly useful for international applicants or those with special circumstances.

To apply by fax, complete Form SS-4 and send it to the appropriate IRS fax number. Processing typically takes about four business days.

For mail applications, submit Form SS-4 to the address specified by the IRS, but expect a longer processing time of approximately 4-5 weeks.

International applicants can call the IRS directly at their international number. This option requires the caller to be authorized, such as the business owner or officer.

Documents needed for non-online applications:

- Completed Form SS-4

- Business formation documents

- Identification of the responsible party

The IRS recommends applying at least 4-5 weeks before needing an EIN when using mail application methods to account for processing times.

Step 3 – Complete The SS-4 Form Correctly

Filling out Form SS-4 requires attention to detail and accuracy. The IRS uses this information to establish your business tax account and issue your Employer Identification Number (EIN).

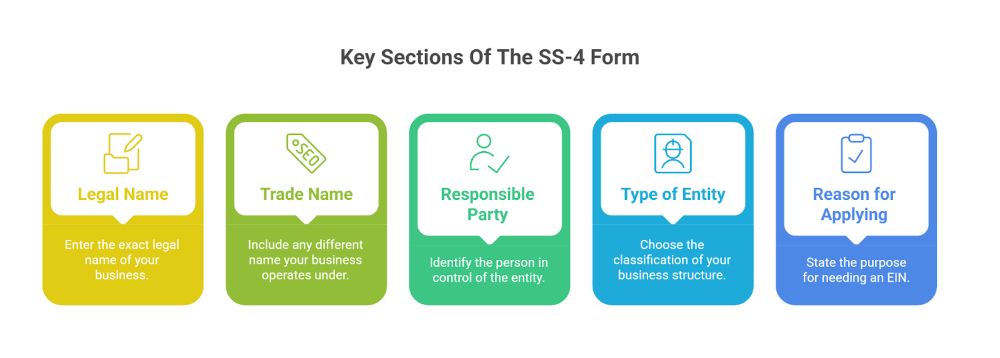

Key Sections Of The SS-4 Form

The SS-4 form contains several critical sections that require specific information about your business entity:

- Legal Name and Trade Name: Enter your business’s legal name exactly as it appears on your legal documents.

- If you operate under a different name, include your trade name (DBA).

- Responsible Party Information: This must be a real person with control over the entity. For LLCs, this is typically the owner or manager.

- Type of Entity: Select the correct classification for your business (sole proprietorship, corporation, LLC, etc.).

- Reason for Applying: Indicate why you need an EIN, such as starting a new business or hiring employees.

- Principal Business Activity: Specify what your business does and include the appropriate business code.

Common Errors To Avoid

Many EIN applications get delayed due to simple mistakes that can be easily prevented:

- Incomplete Information: Every field marked with an asterisk must be completed. Leaving required fields blank will result in application rejection.

- Inconsistent Entity Information: Make sure the information about the responsible party matches your business type. For example, partnerships require at least two names.

- Duplicate Applications: Submitting multiple applications for the same business creates confusion. Before applying, check if your company already has an EIN.

- Wrong Signature: Only the responsible party on the form can sign it. Third-party signatures are not accepted unless proper authorization is attached.

- Date Issues: Include the date your business started or will start operations, as this affects tax filing requirements.

Need help with IRS forms? Connect with Surge Business Law and let us handle your EIN application while you focus on building your business.

Step 4 – Submit Your EIN Application

Once you’ve completed your EIN application form, it’s time to submit it to the IRS. You can submit your application through several methods, depending on what works best for your situation.

What To Expect After Submission

When you submit your EIN application online through the IRS website, you’ll receive your EIN immediately after the information is validated. This makes the online method the fastest way to secure your EIN. You will also receive an important letter from the IRS by mail within 1-2 weeks.

If you choose to apply by fax, you can expect to receive your EIN within four business days. The IRS will send it to the fax number you provided on your application.

For mail applications, prepare to wait 4-5 weeks for processing. Since this method takes significantly longer, it’s important to plan.

International applicants who apply by phone will typically receive their EIN during the same call after all information is verified.

IRS Follow-Up Steps

After submitting your application, the IRS may need additional information to process your request. If this happens, they will contact you using the information provided on your application.

For online applications, verification happens in real time. The system will prompt you immediately if any issues with your submission need correction.

The IRS might send a letter requesting clarification or additional documentation for fax and mail applications. This can extend the processing time, so be sure to respond promptly.

The IRS will not call you for verification purposes without first sending official written communication. Be cautious of fraudulent calls claiming to be from the IRS regarding your EIN application.

Keep a copy of your EIN confirmation letter in a secure location. You’ll need this number for various business activities, including opening bank accounts and filing taxes.

Step 5 – Start Using Your EIN Immediately

Once you receive your EIN from the IRS, you can immediately begin using it for essential business operations.

Your EIN is your business’s tax identification number required for many important business activities.

Opening Business Bank Accounts

Most financial institutions require an EIN to open a business bank account. When visiting the bank, bring the EIN confirmation letter from the IRS and other business formation documents such as articles of incorporation or your business license.

Opening separate business accounts helps maintain clear boundaries between personal and business finances. This separation is crucial for tax purposes and liability protection.

Many banks offer specialized business accounts with features like:

- Merchant services

- Business credit cards

- Lines of credit

- Cash management tools

Business owners should compare account options from multiple banks to find the best fit for their specific needs and fee structures.

Setting Up Payroll And Filing Taxes

The EIN is essential for tax filing requirements and payroll processing. Businesses must use their EIN when filing:

- Federal tax returns

- State tax returns (in most states)

- Employment tax returns

- Excise tax returns, if applicable

For payroll setup, employers need their EIN to:

- Register with state workforce agencies

- Set up federal and state tax withholding

- Process W-2 forms for employees

- File quarterly employment tax returns

Many businesses use payroll software or services to ensure compliance with tax requirements. These services typically ask for the EIN during the initial setup process.

Applying For Business Licenses

Most government agencies require an EIN when applying for business licenses or permits. Depending on the industry and location, businesses may need:

- General business licenses from the city or county governments

- Professional licenses for regulated industries

- Health department permits for food-related businesses

- Special permits for selling regulated products

The application process typically involves submitting the EIN along with other business information. Processing times vary by jurisdiction and license type.

Business owners should research license requirements specific to their industry and location. Many jurisdictions now offer online application portals that streamline the process.

Keep the EIN confirmation letter accessible. It proves the business’s tax identity when applying for various licenses and permits.

Don’t leave your business at risk. Contact Surge Business Law now to ensure your EIN, licensing, and compliance are handled quickly and stress-free.

Frequently Asked Questions

What is the process for obtaining an EIN from the IRS?

You can apply for an EIN through the IRS online system, by mail, fax, or phone. The online method is the fastest, and it provides immediate EIN approval during business hours.

Can I apply for an EIN online, and how does it work?

Yes, you can apply via the IRS website’s EIN tool, available Monday through Friday, 7 a.m. to 10 p.m. ET. Complete the application in about 15 minutes and receive your EIN instantly.

What are the requirements for applying for an EIN?

You’ll need your business’s legal name, entity type, mailing address, and the responsible party’s SSN, ITIN, or EIN. Some businesses may need to provide formation documents.

How long does it take to receive an EIN?

Online applications provide an EIN immediately. Faxed applications take about four business days, while mailed applications may take up to 4 weeks.

Can I look up a company’s EIN?

EINs are generally private. Public companies may list EINs in SEC filings. For non-public companies, you must request it directly if you have a valid business reason.

Are there any fees for obtaining an EIN from the IRS?

No, the IRS issues EINs for free. Avoid third-party services that charge fees for EIN applications; you can complete it at no cost on IRS.gov.