Mastering Essential Licensing Requirements for Small Businesses in Iowa

Iowa has over 275,000 small businesses, which make up more than 99% of the state’s businesses (SBA.gov).

But here’s the catch—many owners rush into opening doors without fully understanding the rules that keep them open.

Getting licensed isn’t just paperwork; it’s about protecting your future, building customer trust, and avoiding costly penalties.

While Iowa doesn’t mandate a general business license, business owners must obtain industry-specific licenses, sales tax permits, and local permits based on their business type and location.

For example, restaurants need food service licenses, contractors require special certifications, and businesses selling taxable goods must secure a sales and use tax permit.

The Business License Information Center, through IASourceLink, provides a comprehensive database to help Iowa entrepreneurs navigate licensing requirements.

Business owners should also obtain an Employer Identification Number (EIN) if they plan to hire employees, as this is a critical step in meeting employer responsibilities.

Key Takeaways

- Iowa doesn’t require a general business license, but specific professional licenses and permits are needed based on industry and business activities.

- Before beginning operations, business owners must obtain local permits, check zoning regulations, and secure sales tax permits.

- Regular renewal of licenses and staying informed about changing regulations help businesses maintain compliance and avoid penalties.

Understanding Iowa’s Business Licensing Ecosystem

Iowa’s approach to business licensing is structured around specific activities rather than general business operations.

Navigating these requirements effectively helps entrepreneurs avoid penalties while establishing legitimate business operations.

Why Licensing Matters for Small Businesses

Proper licensing establishes a business’s legitimacy and legal compliance in Iowa. Operating without required licenses can incur significant penalties, fines, and potential business closure.

Licenses protect consumers by ensuring businesses meet minimum standards for safety and quality.

Iowa does not have a general business license, so it is crucial to identify specific requirements based on your business activities.

Licensing also creates a level playing field for businesses, ensuring all competitors follow the same regulations. This protects both established businesses and newcomers to the market.

Types of Licenses Required in Iowa

Iowa businesses may need several types of licenses depending on their operations:

Professional Licenses: Required for specific occupations, including:

- Healthcare providers

- Accountants

- Real estate agents

- Cosmetologists

Permits and Regulatory Licenses:

- Sales tax permits for retail businesses

- Food service permits for restaurants

- Liquor licenses for alcohol sales

- Zoning and building permits for physical locations

Industry-Specific Licenses: Certain industries, due to their nature. These include childcare centers, construction contractors, and agricultural businesses.

Common Myths About Licensing in Iowa

Myth 1: Iowa requires a general business license for all companies.

Reality: Iowa has no general business license requirement. Licensing is based on specific business activities and professional services.

Myth 2: Once obtained, licenses never need renewal.

Reality: Most licenses require regular renewal, with timeframes varying from annually to every few years, depending on the license type.

Myth 3: Online businesses don’t need licenses.

Reality: Even online businesses need appropriate licenses based on their activities, including sales tax permits for selling to Iowa residents.

Myth 4: Small businesses are exempt from licensing.

Reality: Business size rarely exempts companies from licensing requirements. The nature of the business determines license needs, not its size.

Lost in Iowa’s business maze? One wrong move could cost you thousands. Surge Business Law simplifies business formation so you can launch smoothly—without worrying about hidden legal traps. Contact now.

Core Licenses Every Iowa Small Business Must Know

While Iowa does not require a general business license, entrepreneurs must navigate specific licensing requirements based on their business type, location, and industry. Understanding these requirements is essential for legal operation and avoiding potential penalties.

State-Level Licensing Requirements

Iowa businesses typically need to comply with several state-level requirements. The most common requirement is obtaining a sales and use tax permit if the business sells taxable goods or services.

The Iowa Department of Revenue issues this permit.

Businesses operating as LLCs must register with the Iowa Secretary of State before pursuing specific licenses. This is not a license itself but a prerequisite for legal operation.

Certain regulated industries require specialized state permits:

- Food establishments: Health department licensing

- Alcohol sales: Liquor license from the Alcoholic Beverages Division

- Childcare providers: DHS certification

- Healthcare facilities: Department of Inspections and Appeals approval

The Iowa Licenses & Permits portal is a central resource for business owners to identify and apply for relevant state permits.

Local Licensing by City and County

Businesses must also comply with local regulations that vary by municipality. Most Iowa cities require some form of local business permit or registration. These local requirements often include:

- Zoning permits: Ensuring the business complies with local land use regulations

- Building permits: Required for construction or significant renovations

- Signage permits: Regulating exterior business signage

- Health department inspections: Particularly for food-related businesses

Des Moines, Cedar Rapids, and Iowa City have more comprehensive local licensing requirements than smaller communities. Entrepreneurs should contact their city clerk’s office or county administration early in planning.

Depending on the business type and occupancy levels, local fire departments may also require inspections and permits. This is especially important for businesses serving the public or storing hazardous materials.

Professional Licenses and Industry-Specific Permits

Many professionals must obtain specialized licensing beyond general business requirements. Iowa regulates numerous occupations through various boards and commissions.

Commonly licensed professions include:

- Accountants and CPAs

- Attorneys

- Healthcare providers (doctors, nurses, therapists)

- Real estate agents and brokers

- Insurance agents

- Cosmetologists, aesthetician, and barbers

- Contractors and tradespeople

Industry-specific permits may be required for:

| Industry | Regulatory Agency |

| Restaurants | Department of Inspections and Appeals |

| Daycares | Department of Human Services |

| Transportation | Department of Transportation |

| Financial services | Division of Banking |

New business owners should consult the Small Business Administration to identify all necessary professional credentials.

Professional licenses typically require specific education, exams, and continuing education to maintain good standing.

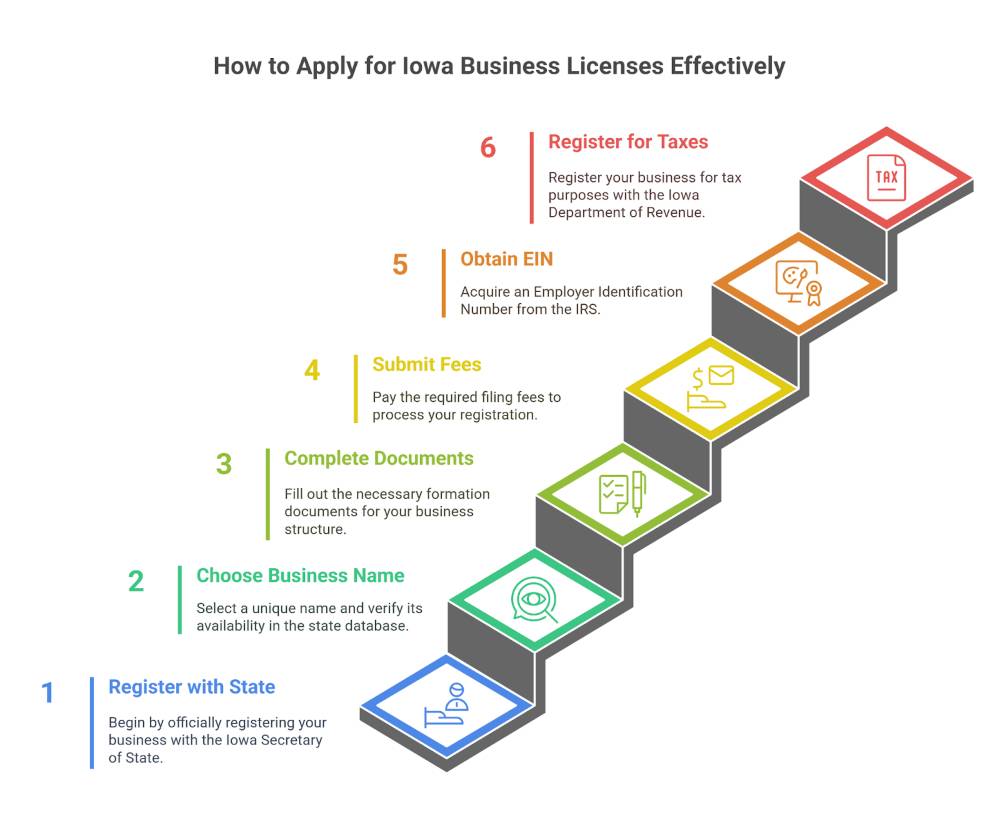

How to Apply for Iowa Business Licenses Effectively

Obtaining the proper business licenses in Iowa involves navigating specific registration processes and understanding requirements that vary by business type.

The state offers several application methods, with online options providing the most efficient path for most entrepreneurs.

Steps to Register Your Business Entity

Start by registering your business with the Iowa Secretary of State. This foundational step establishes your business structure (LLC, corporation, partnership, or sole proprietorship) before you apply for specific licenses.

To properly register your business:

- Choose a unique business name and check availability through the Secretary of State database

- Complete the appropriate formation documents based on your business structure

- Submit required filing fees (ranging from $40-$50 for most entities)

- Obtain an EIN (Employer Identification Number) from the IRS

- Register for tax purposes with the Iowa Department of Revenue

Most businesses can complete registration through GovConnectIowa, the state’s online portal. This system allows digital submission and provides electronic access to your permit letters once approved.

Navigating Iowa Business License Application Portals

Iowa offers multiple channels for license applications, with the online portal providing the greatest convenience. The state’s licensing website is a comprehensive hub for personal and business permits.

Register for sales tax permits at GovConnectIowa. This platform streamlines the application process and maintains your records in one secure location.

Key application portals include:

- GovConnectIowa: Primary portal for tax permits and business registrations

- Iowa.gov Licenses & Permits page: Central directory of all license types

- Professional Licensing Boards: Specific portals for regulated industries

Many businesses also need local permits. Contact your city or county government offices to determine zoning requirements, building permits, and local business licenses that may apply to your operation.

Costs and Timelines for Iowa Business Licenses

Business license fees in Iowa vary significantly depending on your industry and license type.

Basic business registration fees typically range from $40 to $100, while specialized professional licenses may cost considerably more.

Common costs include:

- Business entity registration: $40-$50

- Sales tax permit: No fee

- Professional licenses: $ 50- $ 500+ (varies by profession)

- Local permits: $25-$200 (varies by municipality)

Processing times also vary by license type. Standard business registrations generally take 7-10 business days when filed by mail. You can expedite this process through online filing, which often takes 2-3 business days.

When using the online system for sales tax permits, expect processing within 3-5 business days. Depending on the licensing board and application completeness, professional licenses may take 2-6 weeks.

Licensing errors can stall your success or shut you down. Don’t leave it to chance. Surge Business Law helps you secure every license your Iowa business needs—fast, clear, and hassle-free. Schedule your consultation today.

Staying Compliant: Renewals, Inspections, and Reporting

Maintaining compliance with Iowa’s regulatory requirements demands consistent attention to deadlines, standards, and reporting obligations.

Regularly monitoring renewal dates and inspection schedules helps businesses avoid costly penalties and operational disruptions.

Annual Filings and License Renewals

Iowa businesses must track and complete various renewal requirements to maintain legal operations.

Most food service and retail licenses require annual renewal through Iowa’s Online Food Licensing System. Businesses can access this system by visiting iowa.safefoodinspection.com.

Business owners should create a compliance calendar marking all renewal deadlines. The Department of Inspections, Appeals, & Licensing (DIAL) manages many business licenses, providing online renewal options for convenience.

Common renewal mistakes include:

- Missing renewal deadlines

- Failing to update business information

- Submitting incomplete documentation

- Not budgeting for renewal fees

Many licenses require renewal 30-60 days before expiration. Businesses should maintain proper documentation of all renewals and keep digital backups of licensing records.

Inspections and Compliance Checks

Iowa regulatory agencies conduct regular inspections to ensure businesses meet state standards. Food establishments, healthcare facilities, and childcare centers face the most frequent oversight.

Inspections typically evaluate:

- Health and safety compliance

- Adherence to specific industry regulations

- Proper record-keeping

- Staff certification requirements

The Department of Inspections manages most regulatory visits. Businesses should always maintain inspection-ready facilities rather than scrambling when notified of upcoming visits.

Staff should be trained on compliance requirements and inspection protocols. Certificates of Occupancy verify that buildings meet required codes and are mandatory for new structures or changes in use.

Many industries can access self-assessment tools through their regulatory agencies to prepare for official inspections.

Penalties for Non-Compliance

Failing to meet Iowa’s regulatory requirements can have significant consequences for businesses. Penalties vary based on violation severity, compliance history, and the specific regulation.

Common penalties include:

- Monetary fines (ranging from $100 to $10,000+)

- Temporary license suspension

- Permanent license revocation

- Mandated corrective actions

More serious violations may trigger additional oversight and more frequent inspections. Some infractions may require businesses to temporarily cease operations until violations are remedied. In some cases, even jail time!

The IASourceLink database provides comprehensive information about licensing requirements and potential penalties.

Businesses can request compliance assistance from regulatory agencies before problems arise, often avoiding penalties through voluntary correction programs.

Conclusion

Starting a business in Iowa requires careful attention to licensing requirements. Iowa does not have a general business license, making it easier for entrepreneurs to begin operations.

However, specialized businesses and professionals still need specific permits and licenses, which vary by industry, location, and business activities.

Business owners should research requirements through the Business License Information Center to ensure compliance. They should also obtain necessary tax IDs from the Iowa Department of Revenue.

Some professions require examinations with specific fees. For instance, social work licensees must follow practice guidance and requirements established by state regulations.

Proper licensing protects businesses from penalties and builds customer trust.

Investing in proper compliance helps create a solid foundation for business growth and success in Iowa’s supportive business environment.

Stop second-guessing legal requirements. Surge Business Law safeguards your business with precise licensing services so you can move forward with total confidence and peace of mind. Contact us now.

Frequently Asked Questions

Do I need a business license to operate in Iowa?

Iowa does not require a general state-issued business license, but many businesses must register with the Iowa Secretary of State and may need local city or county permits depending on their industry and location.

What licenses are required to start a small business in Iowa?

Most Iowa businesses must register their entity, obtain a sales tax permit if selling goods or taxable services, and secure local permits or professional licenses specific to their industry.

How do I apply for a business license in Iowa?

To apply, register your business with the Iowa Secretary of State, obtain tax permits from the Iowa Department of Revenue, and check with your city or county clerk for local licenses.

How much does a business license cost in Iowa?

Costs vary by license. State registration fees range from $50 to $100, while local permits can cost between $25 and $400, depending on the business type and location.

How long does it take to get a business license in Iowa?

State registration can be processed within 1-2 business days online, but local permits and industry-specific licenses, depending on approval processes, may take 1-4 weeks.

What happens if I operate without a license in Iowa?

Operating without proper licenses can lead to fines, penalties, business closure, or legal action from local or state authorities.

What is a sales tax permit in Iowa, and who needs it?

A sales tax permit allows businesses to collect and remit sales tax on taxable goods or services. It’s required for most retailers and service providers in Iowa. You can apply through the Iowa Department of Revenue.