How to Close a Business With Overwhelming Debt in Iowa

If your Iowa business is buried in debt, you’re not alone — and you still have options. Many small business owners believe bankruptcy is the only way out, but that’s not always true. In many cases, you can legally dissolve your LLC or corporation without going through bankruptcy court.

When your business owes more than it owns — or you’ve signed any personal guarantees, leases, credit lines, or SBA-backed loans — timing becomes critical.

Dissolving early can protect your limited liability. Getting the timing wrong (especially after a lawsuit or judgment) can expose you personally.

The right legal guidance can protect your personal assets and help you close your business properly under Iowa law.

Key Takeaways

- Dissolution can be a clean, legal way to end a struggling business in Iowa.

- Bankruptcy isn’t always necessary, especially when debts are not personally guaranteed.

- Correct creditor notices and documentation help protect you from personal liability.

- Consulting an attorney ensures the entire process is compliant, strategic, and protective.

Dissolution vs. Bankruptcy: Understanding Your Options

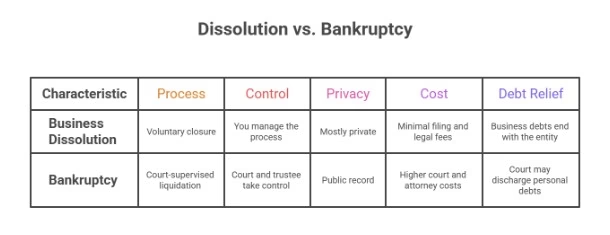

Before deciding how to move forward, it’s important to know the difference between dissolving a business and declaring bankruptcy.

| Business Dissolution | Bankruptcy | |

| Process | Voluntary closure through the Iowa Secretary of State | Court-supervised liquidation |

| Control | You manage the process | The court and the trustee take control |

| Privacy | Mostly private | Public record |

| Cost | Minimal filing and legal fees | Higher court and attorney costs |

| Debt Relief | Business debts end with the entity | The court may discharge personal debts |

Even debt-heavy businesses can dissolve cleanly if their debts aren’t personally guaranteed.

Meanwhile, a business with modest debt may require bankruptcy if the owner guaranteed a lease, an SBA loan, a credit line, or a vendor account. Personal guarantees (and similar owner obligations) — not the amount of debt — are what create personal exposure.

When liens, lawsuits, or tax issues are present, an attorney can help you decide whether bankruptcy protection is the safer route..

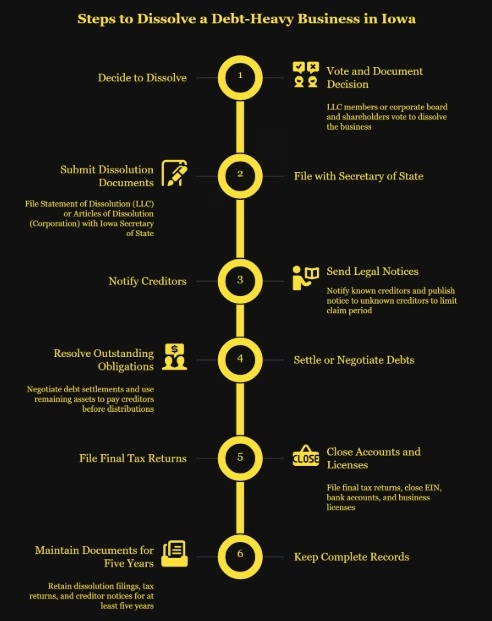

How to Dissolve a Debt-Heavy Business in Iowa

Whether you own an LLC or corporation, Iowa provides a clear legal path to close your company. The key is following the process carefully — and with legal oversight — to protect yourself.

1. Decide to Dissolve

- LLC: Members vote according to the operating agreement.

- Corporation: Board and shareholders approve dissolution.

If you’re the only member or owner, document the decision in writing.

2. File with the Iowa Secretary of State

- File a Statement of Dissolution (LLC) or Articles of Dissolution (Corporation).

- Use Fast Track Filing.

- Filing fee: $5.

3. Notify Creditors Properly

Iowa law requires notice to known creditors and publication notice to unknown ones.

This step limits how long creditors can pursue claims — and must be done correctly to avoid future issues. An attorney can ensure proper wording, timelines, and proof of notice.

Iowa’s claim-cutoff rules under Iowa Code §489.704 (for LLCs) and §490.1406 (for corporations) provide powerful protection — but only when notices are sent with precise timing and wording. Missing this step can leave owners exposed for years.

4. Settle or Negotiate Debts (Avoid Improper Distributions at All Costs)

If assets are insufficient, an attorney can help negotiate reduced settlements or structured payments. Many creditors accept less once they know the business is closing.

But Iowa law requires that all remaining business assets be used to pay debts before owners receive anything. Improper distributions — even accidental ones — can create personal liability years later.

5. File Final Tax Returns and Close Accounts

Mark all tax returns as Final and close your EIN, bank accounts, and licenses.

This ensures that state and federal agencies recognize that the business has ended.

6. Keep Complete Records

Maintain copies of dissolution filings, tax returns, and creditor notices for at least five years. Good records protect you if questions arise later.

Single-Member vs. Multi-Member LLCs

Your ownership structure affects how dissolution works:

- Single-Member LLCs

- Simpler process.

- But personal liability may arise if you have guaranteed loans or personally signed for leases or lines of credit.

- Multi-Member LLCs

- Requires member votes and distribution records.

- More steps, but less personal exposure if done correctly.

An attorney helps ensure all documents — including operating agreements, resolutions, and notices — are handled properly to preserve limited liability protection.

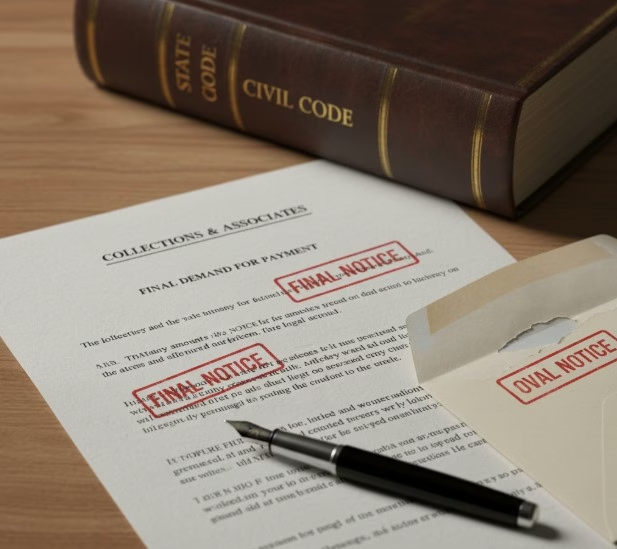

When You Should Consult a Business Attorney

You should speak with an attorney before dissolving your business if:

- The business owes more than it owns

- You’ve signed personal guarantees on debts or leases

- Creditors are threatening legal action

- You’re unsure how to distribute what’s left of your business assets

- You have partners or shareholders with differing opinions

- You want to avoid personal exposure or lawsuits

An Iowa business attorney can:

- Evaluate whether dissolution or bankruptcy is the safer path

- Negotiate directly with creditors

- Protect your personal and family assets

- Ensure compliance with Iowa Code Chapters 489 and 490

- Prevent improper transfers or accidental liability

What Happens to Debt After Dissolution

If you follow Iowa’s process correctly and creditors are properly notified, the company’s remaining debts typically end with the business entity.

However, creditors may still pursue:

- Personal guarantees, regardless of dissolution

- Trust-fund taxes (sales tax, payroll/withholding)

- Fraudulent transfers, if assets were moved to avoid debt

- Improper owner distributions, even accidentally done

These are the exact scenarios where small business owners unknowingly expose themselves — and where legal oversight prevents long-term damage.

Talk to an Iowa Business Attorney

Closing a debt-burdened business is stressful enough — the legal steps shouldn’t be. Surge Business Law helps Iowa business owners understand their options in plain English, without pressure or complicated legal talk.

When you work with Surge Law, you get straightforward guidance on:

- Whether dissolution makes sense or if bankruptcy protection should be considered.

- How to keep your personal finances and assets protected.

- What to do if creditors are calling, threatening action, or holding personal guarantees.

- The exact filings you need with the Iowa Secretary of State.

- How to avoid mistakes that create personal liability later.

You can book a free consultation, or if you want ongoing help as you wind things down, Surge offers flat-fee project work and affordable Momentum memberships for step-by-step support.

The right legal guidance brings clarity, reduces stress, and helps you close your business the right way — cleanly, confidently, and without surprises.

Frequently Asked Questions

Can you dissolve an Iowa LLC if it still owes money?

Yes. Iowa allows an LLC to dissolve even with outstanding debt, as long as creditors are properly notified and the remaining business assets are used to pay claims first. Debts tied to personal guarantees remain the owner’s responsibility.

Do you have to file for bankruptcy to close a business with debt in Iowa?

No. Bankruptcy is usually only required when debts are personally guaranteed, lawsuits are pending, or the business cannot protect itself through normal dissolution. Many Iowa businesses can close through voluntary dissolution without filing for bankruptcy.

What debts follow you after dissolving a business in Iowa?

Personal guarantees, trust-fund taxes, and improper owner distributions can create personal liability after dissolution. Most other business debts end with the entity if Iowa’s notice-and-claims process is properly followed.

How do you notify creditors when dissolving an Iowa business?

You must send a written notice to all known creditors with a clear deadline for filing claims, and publish a notice to unknown creditors. This process shortens how long creditors can pursue your dissolved business.

Can creditors sue you after your Iowa business is dissolved?

Creditors can sue if the debt was personally guaranteed, tax-related, or tied to improper distributions. Proper notices under Iowa law significantly reduce the window for claims against the business itself.

What happens if my business can’t pay all its debts before dissolving?

Creditors may accept reduced settlements or payment plans once informed that the business is closing. If managed carefully, the remaining unpaid debts typically die with the dissolved entity, unless they are personally guaranteed.

Do I need a lawyer to close a debt-heavy business in Iowa?

It isn’t legally required, but legal guidance helps prevent mistakes that can create personal liability. An attorney can manage notices, filings, and creditor negotiations to ensure the dissolution is done safely and correctly.