Starting Right: How Cedar Rapids Startups Reduce Risk with Proper Legal Formation for Long-Term Success

Many new businesses in Cedar Rapids dodge a lot of risk when founders handle legal steps right from the beginning.

The right legal formation helps startups avoid mistakes that lead to costly problems and paves the way for future growth.

Setting up a business carefully means picking the right entity type, gathering the necessary documents, and following local rules. It sounds simple, but the details matter.

Getting help from a skilled attorney during business formation can save time and lower risk.

Legal experts in Cedar Rapids are ready to advise on business formation and finding the best structure for different business goals.

Key Takeaways

- A proper legal setup supports business stability.

- Skipping legal help increases risk and costs.

- The right business structure leads to smoother growth.

Why Legal Formation Matters For Startups In Cedar Rapids

Choosing the right legal structure for a new business in Iowa sets clear roles and defines liability. It also protects owners from personal risk.

Legal formation in Cedar Rapids is crucial for business registration and tax planning. It also opens doors for future opportunities.

The Foundation Of Long-Term Stability

A strong legal foundation shields owners from personal liability. Forming an LLC or corporation in Cedar Rapids protects personal assets from business debts, lawsuits, or other claims.

This separation calms concerns for lenders and investors. They usually want to see a clear line between business and personal finances.

Proper Cedar Rapids startup legal formation allows a company to enter into contracts, own property, and hire employees with legal backing. It also spells out the rights and responsibilities of each founder and partner.

This kind of clarity reduces conflicts and improves decision-making. Startups that follow legal steps early are better prepared for audits and compliance checks.

As noted by business formation attorneys in Cedar Rapids, these actions help avoid penalties and protect against future legal issues.

Early Legal Steps That Shape Future Growth

Selecting and registering the right legal structure shapes how a business is taxed and how profits are shared. It also affects how new funding can be raised.

In Cedar Rapids, options like LLCs, S corporations, corporations, and partnerships each have their own rules and benefits.

Registering a business in Iowa involves paperwork such as name registration, getting an EIN from the IRS, and getting any local permits.

Each step impacts the startup’s ability to open bank accounts and build credit. Skipping agreements between founders can cause ownership disputes, which no one wants.

Getting guidance from local advisors helps startups follow legal compliance practices that reduce risk and support steady growth.

Don’t wait for problems to arise—Surge Business Law helps Cedar Rapids startups avoid costly legal restructuring. Reach out now and secure your business from the ground up.

Risks Of Skipping Legal Counsel During Formation

Skipping legal guidance can cause real headaches for Cedar Rapids startups. Early mistakes in company setup may create risks, slow growth, and block founders from key opportunities.

Personal Liability From Improper Setup

Startup founders who don’t use professional legal advice when forming their company risk personal liability. If a business is set up wrong, courts might decide the business isn’t really separate from the owner.

When this happens, owners might get sued personally for business debts or legal claims.

This situation, called “piercing the corporate veil,” often results from startup formation legal mistakes like failing to keep proper records or mixing personal and business money.

The lack of limited liability protection puts personal assets, like homes, vehicles, and bank accounts, at serious risk. Without the right legal structure and documentation, business debts or lawsuits can spill over into your personal finances.

Legal counsel ensures your business is properly formed and maintained to preserve limited liability protections. Another major risk area? Poorly structured partnerships and multi-owner LLCs.

We frequently see disputes erupt when owners don’t have clear agreements on roles, equity, or exit plans, leading to litigation that could have been avoided with upfront legal planning.

Tax And Compliance Pitfalls In Iowa

Without a lawyer’s help, startups might choose the wrong business entity or ignore state requirements, leading to tax trouble. Different structures, such as LLCs and corporations, each have unique tax impacts in Iowa.

A mistake in structuring could mean higher taxes or even IRS penalties. Iowa also requires businesses to file annual reports or keep certain records.

If a founder fails to meet these requirements, the state can dissolve the business or issue fines.

Legal counsel helps startups stay in good standing with state and federal agencies, which protects the company’s ability to operate.

Funding Rejection Due To Poor Structuring

Investors and banks want to see clean company records and a solid legal structure. If a startup skips legal counsel, it may have missing or confusing ownership documents, unclear shareholder rights, or unsigned contracts.

These startup formation legal mistakes can turn away potential investors who see risk in unclear paperwork. Many investors do background checks and may leave businesses with formation errors.

A strong, well-structured legal foundation gives funders confidence that the startup is serious and set up for long-term success.

Are you starting a business? Surge Business Law offers flat-fee LLC formation for Iowa startups. Contact us today to schedule your free consultation and launch with confidence.

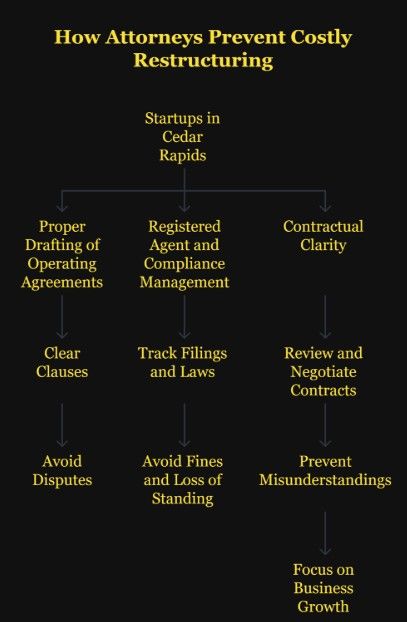

How Attorneys Prevent Costly Restructuring

Startups in Cedar Rapids can avoid expensive mistakes by having the right legal help in place from the start. Careful legal actions keep companies stable and compliant, making life much easier later.

Proper Drafting Of Operating Agreements

A business formation lawyer in Iowa drafts operating agreements to reduce confusion and set clear rules. These written agreements outline each person’s rights, duties, and share of profits.

Clear clauses help avoid disputes down the road. They address what happens if someone wants to leave the company or if ownership changes—details that can quickly become messy if not spelled out.

For example, an operating agreement for an Iowa startup often details voting rights and procedures for admitting new members. This makes business decisions and transitions more predictable.

Attorneys include custom clauses based on the business type, ensuring state laws are followed. A well-drafted operating agreement acts as a guidebook if issues pop up.

It saves time and money when changes or disagreements happen. Early work with a business attorney for startups helps everyone understand their role and the steps needed for company changes.

Registered Agent And Compliance Management

Picking a reliable registered agent is a legal requirement in Iowa and keeps startups organized. This person or service receives legal documents and official notices for the business.

If a startup forgets to handle important paperwork, it might face fines or lose good standing with the state. Attorneys assist entrepreneurs in Cedar Rapids by guiding them through compliance management.

They track annual filings, tax documents, and changes to state laws. With their help, startups avoid missed deadlines and ensure that their information is always updated with state officials.

By managing these tasks, attorneys save founders from having to fix costly errors later. A good compliance system, part of a startup legal checklist in Cedar Rapids, supports steady business growth and less risk of surprise problems.

Contractual Clarity From Day One

Startup attorneys in Cedar Rapids help founders review, draft, and negotiate contracts that protect the new business.

From early supplier deals to agreements with service providers, having contracts reviewed helps prevent misunderstandings.

Legal help ensures each contract spells out what each side must do and what happens if things go wrong. Business contract review in Cedar Rapids adds detail and removes gaps in agreements.

Attorneys look for issues like unclear payment rules or missing intellectual property protections, keeping deals fair and enforceable.

Setting up contracts early helps businesses avoid costly restructuring by stopping disputes from turning into lawsuits. Good legal support means entrepreneurs can focus on their business instead of legal problems later.

Choosing The Right Business Structure In Iowa

Selecting the best business structure shapes taxes, personal risk, and paperwork. For Cedar Rapids founders, common structures include LLCs and corporations, each offering different liability protection and costs.

Formation steps and paperwork requirements can impact operations and future growth. It’s not a one-size-fits-all situation.

LLC Vs Corporation: What’s Right For You?

Forming an LLC is popular among Iowa startups because it is flexible and simpler to manage. LLCs protect personal assets from business debts and lawsuits.

Taxes pass through to the owner, which can lower tax costs. A corporation offers stronger separation between personal and business liabilities, but it requires more formal processes like annual meetings and reporting to the state.

Corporations can issue stock, making them better for startups aiming to raise money from investors. For many, an LLC is often seen as the best business structure for startups in Iowa.

However, companies planning to bring in outside investment sometimes choose to incorporate instead. The decision depends on the company’s size, funding plans, and how much paperwork the founders can handle.

| Feature | LLC | Corporation |

| Liability Protection | Yes | Yes |

| Taxation | Pass-through | Double (unless S-Corp) |

| Annual Requirements | Fewer | More |

| Ability to Raise Capital | Limited | Easier with stock |

Formation Steps Every Cedar Rapids Founder Must Take

To start a business in Iowa, founders first pick a name and check its availability with the Iowa Secretary of State. Next, they file the Iowa Certificate of Organization for an LLC or Articles of Incorporation for a corporation.

Filing fees vary, but flat fee LLC formation options make costs more predictable. Owners should create an operating agreement for LLCs or bylaws for corporations, even if Iowa doesn’t always require them.

This document sets out how the business will be managed. Another key step is obtaining an EIN (Employer Identification Number) from the IRS.

Business licenses, local permits, and opening a separate bank account all help protect the company and keep it compliant.

An Iowa LLC formation guide or legal professional can help answer the question, “What paperwork do I need to start a business in Iowa?” and ensure that all requirements are met.

When To Consider A Legal Restructure

Sometimes, a business just outgrows its old setup and needs to restructure. Maybe you’re shifting from a sole proprietorship to an LLC because you want less personal risk if things go sideways.

Or maybe your company’s starting to take off, and you need to convert from an LLC to a corporation. Attracting investors or fueling growth can help you do this.

In Iowa, restructuring usually means more paperwork and fresh agreements. You might see changes in taxes or licenses, too.

Suppose you’re not sure where to start. In that case, talking to business formation attorneys or a startup lawyer in Cedar Rapids can clear up confusion.

Picking the right time and having your paperwork ready can make everything less stressful and help dodge unnecessary risks.

Conclusion

Legal formation is a crucial step for startups in Cedar Rapids. Picking the right structure helps businesses stay compliant and plan ahead.

When you work with local professionals like business formation attorneys, you can save time and avoid headaches. These experts walk you through the process, offer advice, and handle the paperwork that can trip up new founders.

Having your paperwork in order makes everything easier—getting licenses, opening bank accounts, and even talking to investors.

Taking the time now means fewer problems later, and who doesn’t want that?

The first choices you make as a business stick with you. Focusing on legal formation in Cedar Rapids can boost your odds for growth and long-term success.

Protect your startup beyond formation. Surge Business Law’s Momentum Membership provides monthly legal support, unlimited Q&A, and peace of mind. Contact us today to stay legally protected.

Frequently Asked Questions

What legal documents are needed to start an LLC in Iowa?

To start an LLC in Iowa, you’ll need to file a Certificate of Organization with the Secretary of State, create an operating agreement, obtain an EIN from the IRS, and ensure local licenses are in place. While not legally required, an operating agreement helps LLC owners get the most liability protection.

How much does it cost to form a business in Cedar Rapids?

Forming a business in Cedar Rapids typically costs $50 to $100 for state filing fees. If you use a business attorney, flat-fee packages range from $500 to $1,200, depending on complexity and included services.

Can I change my business structure later?

Yes, you can restructure your business later, but it often involves legal paperwork, tax implications, and re-registering contracts. Starting with the right structure reduces the cost and risk of future changes.

Should I use a template for my operating agreement?

Templates can miss critical clauses specific to Iowa law or your business type. A custom operating agreement drafted by a Cedar Rapids attorney helps prevent costly disputes and ensures local legal compliance.

What’s the best business structure for tech startups in Iowa?

Most tech startups benefit from forming a C-corporation if seeking investment or an LLC for flexibility and lower administrative costs. Choosing the right structure depends on ownership goals and funding plans.

Do I need a lawyer to start a business in Iowa?

While not legally required, having a business lawyer helps ensure compliance, limit liability, and avoid costly restructuring. Most successful startups consult legal counsel early in their formation phase.

What are the risks of starting without legal help?

Starting without legal help can lead to personal liability, tax problems, partner disputes, and contract issues. A proactive legal setup protects your startup and builds a foundation for growth.